Wire Transfer Services

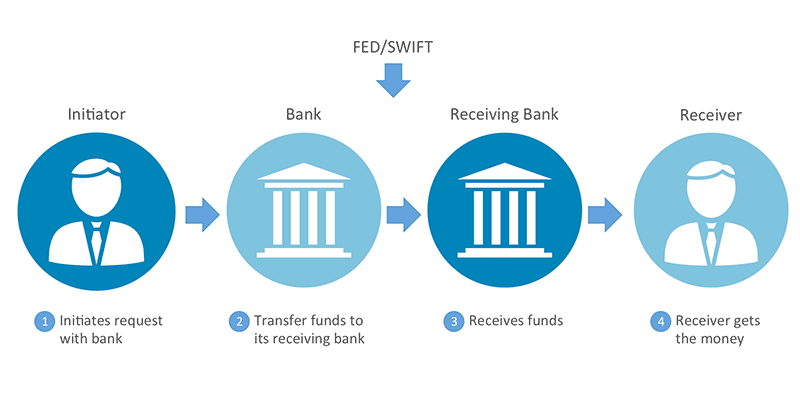

Wire Transfer provides your business with a fast, highly secure transfer system for moving funds to and from accounts at other banks.

Who can benefit from wires?

- Companies that would like to quickly and securely move funds through financial networks and/or banking relationships

- Organizations looking to reduce credit card chargeback and NSF activity

- Businesses sending or receiving payments internationally

Advantages of wires

- Ease of use – template creation for repetitive payments and online user profile management

- Efficiency – the fastest way to send money

- Security – offers multiple layers of security as well as configurable user permissions and transfer limits

- Final Payment – wire transfers provide a payee finality of payment that cannot be debited from their account without authorization unless fraud is involved

- Currency – international wires allow you to access competitive exchange rates in real time and in multiple currencies

- Reporting – delivers notification of payment sent or received for accurate record keeping

Types of wires

- Domestic – settled from same day to two business days

- International – settled same or next business day

Using wires

Once enrolled, wires can be initiated via phone, online, or as batches of multiple wires sent in the same file.

Fraud security: Blocking international wires

If your business initiates wires inside the U.S. only, you can easily prevent foreign hackers from fraudulently originating wires and sending your funds overseas. Our International Wire Block automatically rejects all international wire transfers on your account regardless of the source (online, telephone, or via the financial center). All attempts are blocked and reported to you. There’s nothing more you have to do.

This product is supported by our Business Connect or Treasury Connect platform. To Enroll, Digital Banking clients should consult with their First Horizon Banker.