Wire Transfer Services

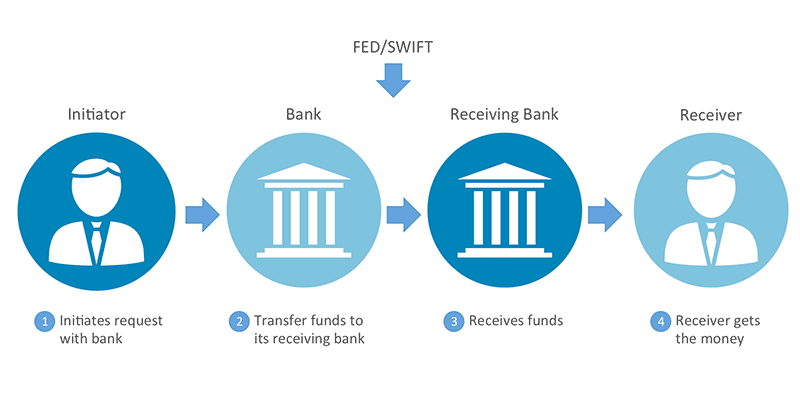

Wire Transfer provides your business with a fast, highly secure electronic transfer system for moving funds to and from accounts at other banks. As soon as the wire is received, the funds are considered collected and available for immediate use.

Who can benefit from wires?

- Companies that would like to quickly and securely move funds through financial networks and/or banking relationships.

- Companies needing to send large dollar amounts to support business and/or lending arrangements.

- Organizations looking to reduce credit card chargeback and NSF activity.

- Businesses sending or receiving international payments.

Advantages of wires

- Ease of use – template creation for repetitive payments and online user profile management.

- Efficiency – the fastest way to send money.

- Security – offers multiple layers of security as well as configurable user permissions and transfer limits.

- Final Payment – wire transfers provide a payee finality of payment that cannot be debited from the receiving account without authorization unless fraud is involved.

- Currency – international wires can be originated in USD or foreign currency and allow you to access competitive exchange rates in real time for multiple currencies.

- Reporting – notification of payment sent or received can be provided online or via email for accurate record keeping.

Types of wires

- Domestic – beneficiary bank is within the United States.

- Funds settle almost immediately, same day.

- International – beneficiary bank is outside the United States.

- Funds in USD – settle same or next business day.

- Funds in FX – settle in two business days.

Using wires

Once enrolled, wires can be initiated online, as batches of multiple wires, in person at a financial center or via telephone with a PIN.

Fraud security: Blocking international wires

If your business initiates wires inside the U.S. only, you can prevent account takeovers from fraudulently originating wires and sending your funds to beneficiary banks outside the United States. Our International Wire Block automatically rejects all international wire transfers on your account regardless of the source (online, telephone, or via the financial center). All attempts are blocked and reported to you. There’s nothing more you have to do.