By the time you read this, Election Day will have come and gone.

You may or may not know the outcome yet, but all things come with an adequate amount of time.

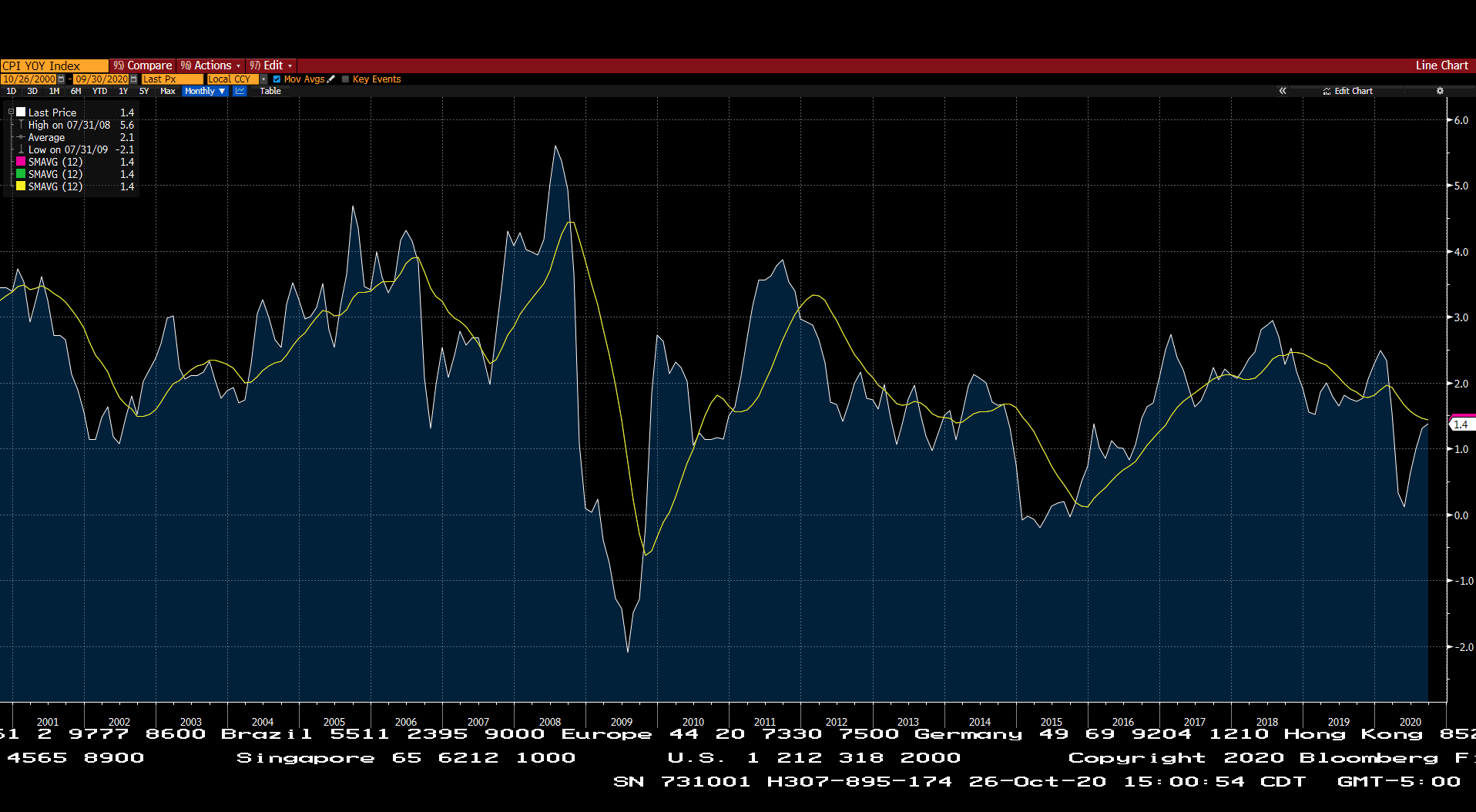

What we do know is that interest rates are low. And we think that inflation is not going to reemerge any time soon in spite of the Fed’s interest in seeing it at or above 2%.

Should you be at all concerned about an inflation target of 2%? If you are planning to be around a long time, the answer is yes. Take a look at the following graphic to see why:

Over a 20 year period, inflation of “just” 2% will cause prices to rise 46%!

In a world where 10 year U.S. Treasury notes are yielding less than 1%, it’s going to be very difficult to keep up with that.

Net of inflation, the “real” yield on 10 year U.S. Treasury notes is negative. A nominal (pre-inflation) yield of 0.80% minus inflation (Consumer Price Index, or CPI) of 1.4% (Bureau of Labor Statistics September 2020 report) generates a “real” inflation adjusted return of -0.60%. Is there a better store of value?

Probably not without incurring quite a good deal of risk. Gold has historically been thought of as a good long term store of value, but wide fluctuations in price can be off putting in the short term. Foreign currencies have the same issue.

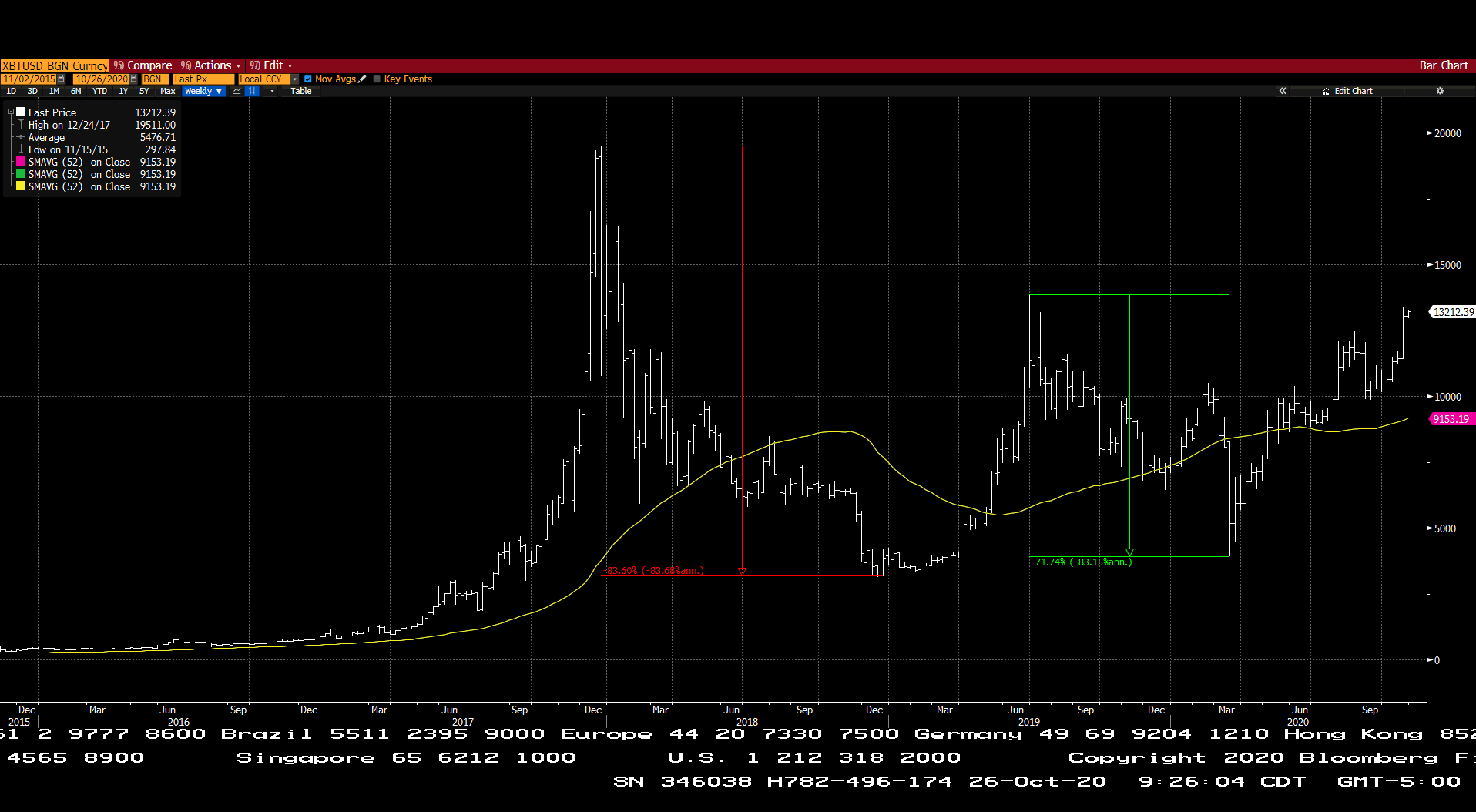

More recently cryptocurrencies have gained attention as legendary hedge fund investor Paul Tudor Jones made a case for Bitcoin in an interview on CNBC’s Squawk Box on October 22, 2020. Unfortunately, Bitcoin is very volatile, too, generating drawdowns of over 70% on two occasions in the last three years.

So why doesn’t the Fed just target higher rates? The theory is that higher rates would hobble the economy by making it costlier to borrow money and invest. Keep in mind, too, that higher interest rates result in higher discount rates that are used to value assets. The last thing investors want to see is the valuation of what they own going down. The next table illustrates the point.

When the discount rate doubles, the value of the cash flow shrinks 50%!

So here we are, afraid of both inflation and higher interest rates with no reliable store of value in sight. Stuck, as it were, between the devil and the deep blue sea.

Jerry Laurain, CFA

Chief Investment Officer, President, Advisory Services

The contents of this newsletter should be used for informational purposes and should not be considered an offer to buy or sell a security or investment in a particular portfolio or strategy. Opinions in this newsletter are subject to change without notice.